The first step in the property development process is opportunity definition. This is when potentially rewarding alternative concepts are identified and explored, followed by selection of the most suitable opportunity.

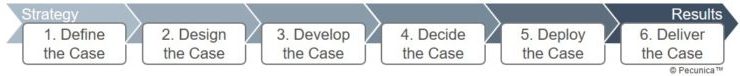

For any project, a business case must be developed and presented in a carefully constructed document that describes, refines and defines the project concept. It justifies the project based on its expected commercial benefit and success and is used to determine the intended stakeholders and to generate their support and approvals.

The business case for a new project establishes the need, defines the nature of the business, justifies its financing and investment, provides a cost-benefit analysis, and estimates its potential profitability. It also determines the most appropriate business model and leads to detailed financial modeling and analysis.

The business case examines alternative opportunities, the project's production and investment, and recommends the course of action that will create the most business value. It may result in the selection of an alternative project that meets the opportunity definition.

A preliminary feasibility analysis is generally conducted for the “go/no-go” decision to further pursue the intended development project. If favorable, a comprehensive market and financial feasibility study is generally undertaken as the basis for the business case and a full business plan is developed.

The preliminary funding analysis projects how much capital is needed, the sources of capital, returns on investment, and other financial considerations. It serves as the basis for the financing terms and conditions.

The resulting capital plan will explain financial risks and opportunities and the impact of proceeding or not proceeding with the project. Recommendations are made along with providing evidence that the proposed action is the optimal solution under the given circumstances.

The business case for sustainability establishes the business benefits to sustainable development and the "greening" of operations. The economic benefits include cost savings, competitive advantage, employee loyalty, customer retention, regulatory compliance, and risk management.