For initial recognition, both US GAAP and IFRS differentiate between finance and operating leases. US GAAP calls for a bright-line test to distinguish between capital and operating leases, whereby it is determined whether the lease term is 75% or more of the asset’s economic life and whether the present value of the lease payments is 90% or more of the leased asset’s fair value. IFRS requires a determination to be made as to whether the lease term of a finance lease is for the “major part” of the asset’s economic life and whether its present value is “substantially equal” to the asset’s fair market value.

To account for an operating lease under both US GAAP and IFRS, the lessor reports a fixed asset on its balance sheet and recognizes periodic rental payments as rental income on the income statement on a straight-line basis over the lease term, unless another basis is more representative of the earning process. The cost of the asset in operating leases is depreciated in a manner consistent with the lessor’s normal depreciation policy for similar depreciable assets.

| Lessor Recognition of Rental on Operating Lease | ||||

|---|---|---|---|---|

| Date | Cash | xxxx | ||

| Rental Income | xxxx | |||

| To record income earned on an operating lease | ||||

Initial direct costs incurred by the lessor in originating an operating lease are recorded as an asset (capitalized) and matched against rental income over the lease term. Executory costs incurred under an operating lease are normally paid by the lessor as operating expenses in the period incurred and matched against the gross rental income.

Whereas US GAAP classifies a capital lease for lessors as either a direct-financing or sales-type lease, IFRS differentiates between finance leases where the lessor is not the manufacturer or dealer of the asset and those where the lessor is also the asset’s manufacturer or dealer. Where US GAAP currently addresses the accounting for leveraged leases, IFRS does not have the concept – the specialized accounting for leveraged leases under US GAAP will be eliminated when the new lease accounting standard goes into effect in 2019.

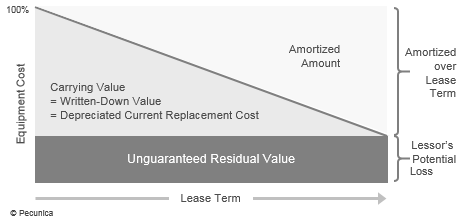

| Lessor Lease Amortization |

Source:

|