Developers adopt sustainability strategies to identify opportunities to benefit from improved environmental, social and governance (ESG) performance. ESG analyses include financial feasibility analysis as well as social and environmental impact assessments.

ESG metrics are incorporated into feasibility studies in deciding whether to initiate a project. Sustainability in property development projects must be implemented upon project conceptualization.

ESG analyses are used to guide project planning and design. Developers, lenders and financial investors must support ESG analyses during conceptual planning and building design to understand the project’s risks and commercial feasibility.

The highest return on the investment can be realized when sustainability principles are implemented in the project design. Sustainable design ensures that the sustainability issues of the various stakeholders are considered for their feasibility assessment throughout the project's whole-life cycle.

Sustainability is taken into account by lenders during the implementation and operation of the project. The return on investment (ROI) in a project is realized by the developer, operator and investors along the value chain.

Architects and designers must be consulted for the implementation of sustainable development principles. Their advice influences the success of a project for all stakeholders and is essential for attaining the goal of sustainable development.

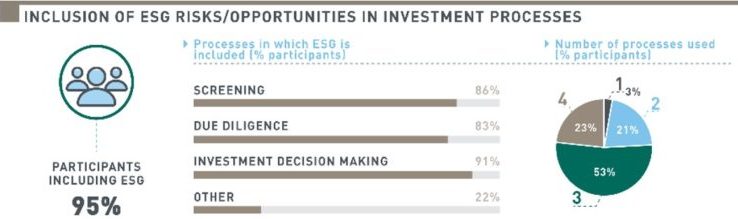

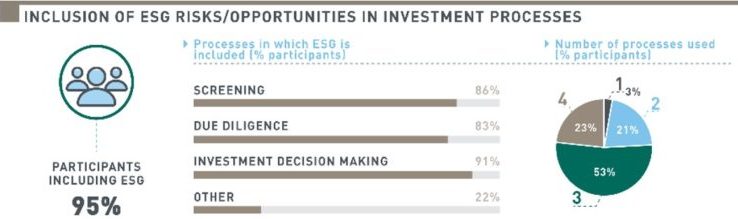

Besides impacting social and operational performance, ESG performance has a significant impact on the cost of capital. ESG factors are considered in the decision-making and portfolio management of investors, as they correlate with low volatility and stability in return on capital employed.

Financial investors evaluate ESG data made available from project developers when conducting their due diligence, often through external technical advisors. For this, they incorporate material ESG criteria into their internal rate of return (IRR) analyses and net present value (NPV) calculations.

For sustainable development, feasibility analyses must consider the respective sustainability issues of all project stakeholders. It calls for collaboration between all parties to produce sustainable and high-performance properties throughout their extended life cycle.