Property bonds are generally high-yield intermediate-term bonds issued by property developers and construction companies to fund property development projects during their construction phase. Mortgage bonds are long-term corporate bonds secured by the pledge of specific commercial real estate owned by the issuer, such as land and buildings.

A covered bond is a generally fixed-rate capital market debt instrument secured by both the issuer’s creditworthiness and a high-quality collateral pool, mostly high-grade mortgages or loans to the public sector. They are issued directly by a financial institution that is liable for the security’s repayment and backed by the special pool of collateral.

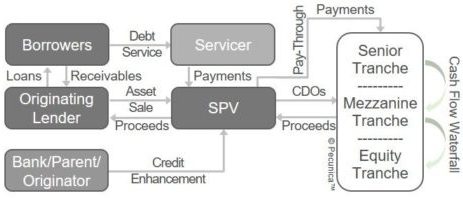

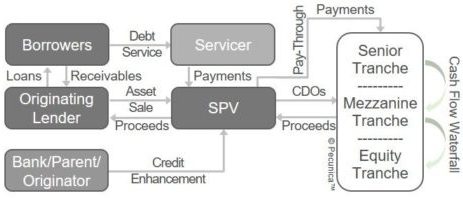

A mortgage-backed security (MBS) is a securitized debt obligation that represents a claim to the cash flows from mortgage loans from originating lenders that are grouped into a single pool that serves as collateral for the securities. As a pass-through security, the payments of interest and principal received by the issuing SPV on the pooled assets are passed to the investors in equal measure in the same period received net of service fees, with every investor having equal rights over the cash flows.

Large commercial properties may be financed by commercial mortgage-backed securities (CMBS) in the form of a collateral mortgage obligation (CMO). As a pay-through security, the payments received by the SPV on the pooled loans are first used for payment to the senior tranches and then paid to more junior tranches only when the priority claims of the senior creditors are fully satisfied (the “cashflow waterfall”).

The commercial mortgage-backed securities (CMBS) market, a major source of capital for many hotel owners. Out of the $300 billion in CMBS loans in the US, hotels comprise $86 billion in debt in 2019.