The crowdlending process begins with a prospective borrower applying or registering with a P2P platform for a loan. The borrower provides credit information and goes through a series of checks and assessments for the determination of the loan's risk and suitability.

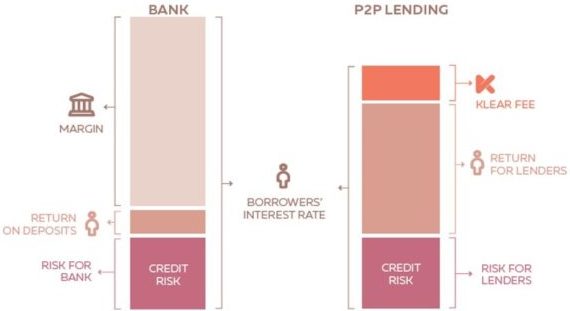

If a loan fits a platform’s product type and the credit risk is acceptable, the platform will price the loan. Rather than a margin that is received by banks, P2P platforms generally earn ongoing fees from their loan book to fund the continued servicing of the loans.

Crowdlending platforms generally support the investors' loan selection process and provide a credit risk assessment of the loans and projects. This usually comes in the form of credit scores sourced from third-party credit bureaus or generated by in-house credit models.

P2P lending may be backed by real property (real estate) or personal property (chattel) or provided on an unsecured basis. General loans are unsecured and not backed by any collateral from the borrower’s side.

In marketplace/P2P property lending, funding is secured by the borrower's real property. Loan securitization by marketplace lenders is backed by consumer, business and property loans. When banks originate loans for P2P lending platforms, the lenders' funds also serve as collateral for the loans.

The possibility of loss resulting from the failure of a P2P platform to perform properly or cease to operate altogether is platform risk. Other risks that P2P platforms are exposed to include fraud risk, operational risk, and information security risk. These risks can be mitigated by segregating customers’ accounts from the platforms' assets, outsourcing loan administration to a third party, capital and professional requirements for platforms, and insurance protection guarantees.

Regulatory risk is the possibility of changes in the regulatory environment that can adversely affect the business. Regulatory uncertainty creates tension between facilitating the growth of the crowdlending industry against the need to ensure adequate investor protection.