A bond is any capital market debt instrument. Bonds are generally categorized according to their issuer as government bonds, agencies (national government agencies and government-sponsored enterprises), municipal bonds of state and local governments, and corporate bonds.

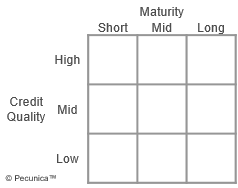

A bond fund is an investment fund that invests primarily in bonds or other types of debt securities and classified by their primary underlying assets. Bond funds are further classified according to the underlying’s credit quality (low, medium, high), maturity (short-, medium- or long-term), or some other feature, such as zero-coupon, high-yield, international, multisector or convertible.

| A Style Box for Bond Funds |

Source:

|

The main types of bond funds and their respective focus are:

- Government bond fund – The notes and bonds of a central government serving as its underlying assets, where such government bond funds in the US are comprised of Treasury notes and Treasury bonds;

- Agency bond fund – Principally debt securities issued by a national government agency, such as the Government National Mortgage Association (Ginnie Mae), or a government-sponsored enterprise (GSE) for a public purpose, such the Federal Home Loan Mortgage Corporation (Freddie Mac) or the Federal National Mortgage Association (Fannie Mae) in the United States;

- Municipal bond fund – The principal underlying assets are intermediate- to long-term bonds issued by local government authorities as well as by enterprises with a public purpose, which are exempt from US federal tax and usually from taxation in the state of issue;

- Corporate bond fund – Mainly corporate bonds of any maturity, which are the secured or unsecured, coupon-bearing or discount capital market debt instruments issued by corporations, as opposed to bonds issued by central or local government authorities and agencies.

Bond funds pay dividends that include the interest income and any capital gain on the fund's underlying securities. Interest income comprises most of the total return on bond funds, although capital gains and losses may be generated by the fund manager when buying and selling the portfolio assets.