Any lease that is not classified for accounting purposes as an operating lease is a finance lease. A finance lease (more commonly known as a "capital lease" in the US) is a noncancellable lease used to finance long-life capital assets that transfers substantially all risks and rewards of an asset’s ownership from the lessor to the lessee for a fixed term in exchange for periodic rental payment.

A finance lease is a popular alternative to conventional borrowing in order to finance acquisition the acquisition of an asset or essentially all its service potential from its manufacturer or vendor. While the lessor finances the asset’s purchase, the lessee is generally responsible for the leased asset’s maintenance, insurance and taxation as well as any loss to the lessor due to early termination. In a finance lease, the lessee makes payments that cover the majority – if not all – of the lessor’s investment in the leased asset.

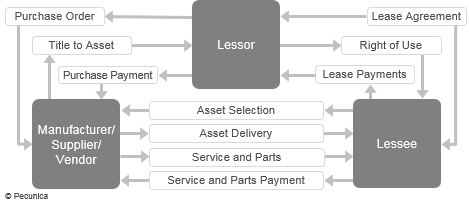

| Finance/Capital Lease Transaction Flows |

Source:

|

A finance lease is often called a "full-payout lease" (FPO) since the scheduled lease payments during the lease term are sufficient to fully amortize the cost of the leased asset and to yield an appropriate return on the lessor’s investment in the asset, with no reliance on the leased asset’s residual value. The lessor’s main objective in a finance lease is to recover the capital it invested in the leased asset and to earn an adequate profit.

Full-Payout Lease = Lessor’s Full Recovery of Investment + Required ROI