The main reasons for lessors to engage in lease syndication are to:

- Obtain funding for big-ticket transactions;

- Reduce the lease originator’s exposure to credits and maintain prudent and manageable credit exposure to specific credits and industries;

- Reduce the lease originator’s residual value risk;

- Increase lease volume and income without increasing the sales force;

- Obtain fee income for the origination and lease underwriting;

- Provide financing to the lessee on competitive terms; and

- Reduce the lease originator’s regulatory capital requirements.

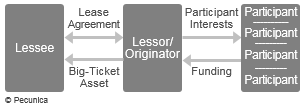

A participation interest is the collateral assignment of the rental stream under a lease and a security interest in the leased asset to multiple funders on a pro-rata basis to secure their funding of the lease, upon payment of consideration to the lease originator, typically on a nonrecourse basis. However, if the funder is to enjoy the tax benefits and residual value of the assets, outright assignment is used rather than the participation interest structure.

| Participant Interest Structure |

Source:

|

The participation interest structure is not used with US tax leases because assignment of an interest in a leased asset could be construed by the US Internal Revenue Service (IRS) as the forming of a partnership between the originating lessor and the participants. This would adversely affect the originator's ability to depreciate the leased asset and utilize other tax benefits of asset ownership and require the originator and the participants to file a partnership tax return.

Participation Interest Structure = Partnership under US Tax Law