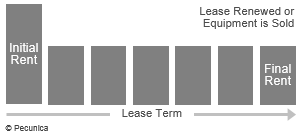

Lease payments that remain constant over the lease term while the interest portion declines and the outstanding balance on the lease obligation is reduced are level payments. Level payment, which is the most common payment structure, is used to match the revenue and cash flow generated by the leased asset with the asset’s depreciation expense on a straight-line basis and to fully amortize the lease. Since the lease has no residual value at the end of the lease term, the level payment structure exposes the lessor to no residual value risk.

| Lease with Level Payments |

Source:

|

Lease payments may increase, decrease or fluctuate with the revenue generated by the leased asset. Step-up payments increase lease payment at one or more points during the lease term. Step-down payments decrease lease payment at one or more points during the lease term, analogous to accelerated depreciation. Lease payments that reflect the seasonal nature of the revenue generated by the leased asset over the lease term are seasonal payments.

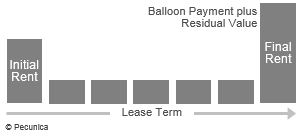

A balloon payment structure is one that provides for level periodic payments during the lease term that are relatively low and a relatively large final rental payment at the end of the lease, expressed as a percentage of the total asset value (e.g., 30%). At the end of the lease term, the lessee typically has the option to either make the lump-sum payment to cover the unpaid portion and keep the asset, refinance the amount due and extend the lease or sell the asset and use the sale proceeds to settle the outstanding amount of the lease obligation. While it improves the lessee’s cash flow in the early years, a balloon payment structure increases the lessor’s residual value risk and credit risk exposure to the lessee.

| Finance Lease with Balloon Payment |

Source:

|

With deferred payment, lease payment that is due after a rent-free grace period and used for assets that do not generate revenue or cost savings until after they have been fully integrated in the lessee’s operations. Deferred rental payment increases the total interest payable during the lease term.

Lease payments that are not fixed in amount but instead depend on the occurrence of some specified event other than simply the passage of time are contingent rentals. Contingent rentals can be dependent on the percentage of sales, price indices, market interest rates or the amount the leased asset is actually utilized.

Leave A Comment

You must be logged in to post a comment.