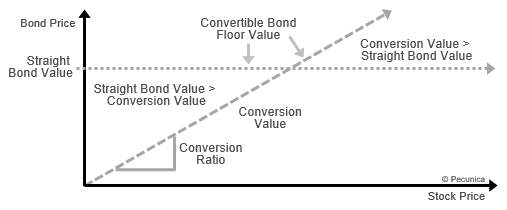

A convertible bond’s minimum price is the greater of either its conversion value or its straight value, which equals the present value of the bond’s cash flows discounted using the required yield on otherwise comparable nonconvertible bonds. If the bond does not sell for the greater of these two values, arbitrage profits may be possible.

Like subscription rights and subscription warrants, a convertible typically gives its holders the possibility to buy newly issued stock from the bond issuer at a fixed price. The conversion price is the fixed amount of par value of a convertible bond in exchange for one share of the underlying stock. It is typically significantly higher than the underlying stock’s current market price when the bond is issued to discourage investors from immediately converting the bond.

Conversion Price = Bond Par Value/Conversion Ratio

The conversion ratio (conversion rate) is the multiple expressing the fixed amount of underlying into which a bond can be exchanged, it being set at the time of the bond’s issuance. The conversion ratio times the conversion price will equal the bond’s par value. The indentures of convertibles contain an anti-dilution clause allowing for the proportionate adjustment to the conversion ratio in the event of a stock dividend or split, thereby protecting convertible holders against dilution.

Conversion Ratio = Bond Par Value/Conversion Price

The total market value of the underlying security into which a convertible bond can be currently exchanged is its conversion value (i.e., conversion ratio x current stock price). A conversion premium is the percentage amount by which the bond sells above its conversion value.

| Convertible Bond Conversion and Floor Value |

Source:

|

Conversion Value = Conversion Ratio x Current Price per Share

Conversion Premium = (Bond Current Price – Conversion Value)/Conversion Value

Leave A Comment

You must be logged in to post a comment.