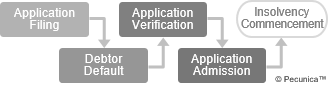

| Initiation of Commercial Insolvency |

Source:

|

An administrator is a licensed insolvency practitioner – individual or entity – appointed by and accountable to the court, tribunal or agency with jurisdiction over insolvency cases. The administrator acts in place of, or together with, a debtor’s management during insolvency proceedings and is vested with the responsibility of supervising the operation of the business, making recommendations on its viability and, possibly, preparing a plan of reorganization or handling the debtor’s liquidation. Although “administrator” generally refers to a person appointed by a court to manage the affairs of an insolvent business with a view to reorganizing it, the term is used generically to also encompass a liquidator. A liquidator is the person designated by the court, tribunal or agency with jurisdiction over an insolvency case to handle the liquidation of the insolvent enterprise by managing, collecting and distributing the business’s assets.

Fraudulent conveyance is the transfer of real or personal property to a third party with the goal to delay, defraud or keep a present or future creditor from obtaining the property. Constructive fraud is the transfer of real or personal property for less than it is worth, while actual fraud is the intentional action to defraud creditors. Preference conveyance is the transfer of assets or payment of a debt to a creditor shortly before going into bankruptcy. If deemed fraudulent transfer, a guarantee may be clawed back by the administrator in the event of a restructuring or liquidation by filing a motion or petition with the appropriate court or authority that seeks the return of assets that were fraudulently transferred.

| Fraudulent Transfer (Example) | |||

| “The debtor/transferor holds assets valued at $14 billion immediately prior to the fraudulent transfer. In addition, the debtor is financed with $8 billion in liabilities, which are comprised of $2 billion in senior secured debt, $2 billion in unsecured notes and $4 billion in other unsecured liabilities. The transferee, on the other hand, has $5 billion in creditor claims against only $2 billion in assets prior to the transfer. [The] debtor transfers $8 billion of its assets to the transferee.” | |||

| Source: Winston & Strawn | |||