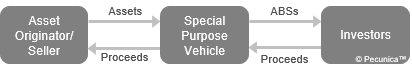

A true-sale securitization is the outright nonrecourse sale of assets selected for securitization by the originator to a special purpose vehicle (SPV), thereby transferring the ownership rights and risks of the assets and removing them from the originator’s balance sheet. A synthetic securitization is the transfer of credit risk to third parties through the use of credit derivatives, whereby the securitized assets are not sold by the originating bank, but remain on the bank’s balance sheet.

A true sale is the outright nonrecourse sale of assets to a third party, whereby the assets and all their rights are irrevocably (absolutely) transferred from the seller to the buyer and legally separated from those of the originator. A true sale of the assets to the bankruptcy-remote SPV separates the risk of the pooled assets from the overall risk of the asset originator.

| True Sale of Assets in Asset Securitization |

Source:

|

There are several advantages to true-sale asset securitization for the asset originator, including

- Transformation of illiquid nonnegotiable assets into marketable instruments;

- Removal of highly illiquid assets from the originator’s balance sheet that would otherwise be held by the lessor to maturity;

- Reduction of the cost of funds by “unlocking value” in the higher credit quality of the segregated pool of leases, rather than obtaining financing based on the lessor’s lower general credit rating;

- Improvement in cash flow (liquidity) and profitability through the conversion of the receivables into cash – “income acceleration”;

- Transfer of credit, interest-rate and prepayment risk of the receivables to investors; and

- Reduction in the lessor’s regulatory capital requirements.