A lease titling trust is an SPV used in the securitization of leased motor vehicles that allows the sponsor lessor to transfer its beneficial rights to receive cash flows from the leased assets and the leases – monthly lease payments and proceeds from the sale or other disposition of the leased vehicles – without requiring the retitling and reregistration of the vehicles. A titling trust is generally owned directly by the sponsor lessor and used to avoid the administration and expense associated with retitling and reregistering the leased vehicles that are used as collateral. The activities of lease titling trusts are limited to owning the leased vehicles and the related leases. The sponsor lessor owns all titling trust assets for both accounting and tax purposes until securitization occurs. Closed-end leases, requiring the originator to take possession of the asset at the end of the lease term, usually collateralize US auto lease ABSs, and use a lease titling trust.

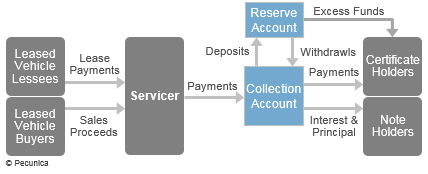

The originator/seller of the auto lease receivables will generally act as the master servicer, whose duties include billing and collecting, following up on delinquent accounts, initiating repossessions, accounting for collections, and reporting monthly collection activities, including defaults and delinquencies, to the trustee for the benefit of the noteholders. Collections received from lessees are deposited into a collection account, which is controlled by the securitization indenture trustee for the purposes of Article 9 of the UCC. Any delays in receiving the cash flows are addressed within the structure through overcollateralization and a cash reserve account, which is a form of hard credit enhancement available to pay interest and sometimes principal on the securitization obligations. The senior securities are further credit enhanced through the subordination of the other tranches.

| The Lease Titling Trust Structure and Flow Process |

Source:

|