A costs that results directly from and is essential to the origination or acquisition of a transaction and that the entity would not have incurred had that transaction not occurred is an initial direct cost (IDC). It can be either incremental or internal:

- Incremental direct cost – A cost incurred with an independent third party for originating a lease, such as a commission to an independent broker for finding the lessee, the cost of an outside credit check of the lessee or the cost of independent appraisal of collateral used to secure a lease;

- Internal direct cost – A cost that directly results from the lessor in originating a lease transaction, such as evaluating the prospective lessee’s financial condition, evaluating and recording guarantees, collateral, and other security arrangements, negotiating lease terms and preparing and processing lease documents, and closing the transaction.

Initial Direct Costs = Incremental Direct Costs + Internal Direct Costs

Initial direct costs exclude internal indirect costs, which are those operating costs of a lessor that are not directly associated with the activity of originating a lease, such as administration and marketing costs, rent as well as costs related to servicing existing leases and establishing and monitoring credit policies.

Initial direct costs are capitalized by the lessor for operating and direct-financing leases – not for sales-type leases – and deferred and amortized over the lease term in proportion to the recognition of rental income. For sales-type leases, initial direct costs are expensed in the same period as the revenue from the sale of the leased asset is recognized.

Ownership-type operating costs such as insurance, maintenance and taxes incurred for leased asset pertaining to the current period are executory costs. Executory costs are excluded from the minimum lease payments and are normally borne by the party who in substance is the owner of the asset. If paid directly by the lessee, they are expensed when incurred.

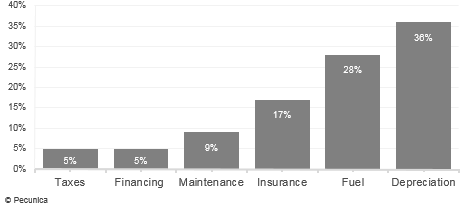

| The Cost of Vehicle Ownership and Operation |

Source:

|