Obligor = Debtor + Guarantor

A third party that is held liable for a debtor’s contractual performance in the event the debtor does not pay or otherwise perform on its obligation is a guarantor. A guarantor is typically discharged of the guarantee only upon full satisfaction of the guaranteed obligation. Guarantees must be given in exchange for a commensurate economic benefit to their guarantors. Only if the guarantor of the residual value of a lease is not related to the lessor is it considered guaranteed.

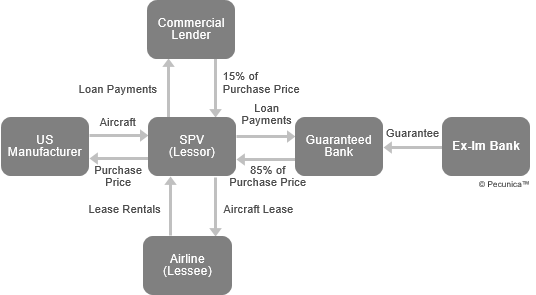

| Aircraft Lease Guaranteed by the US Ex-Im Bank |

Source:

|

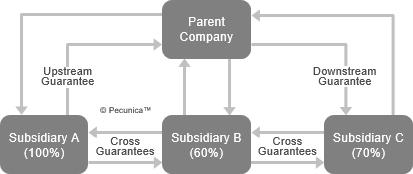

A parent-to-subsidiary (downstream) guarantee, where a parent guarantees a subsidiary’s debt, tends not to be questioned since a loan to a subsidiary implicitly benefits the parent. Subsidiary-to-parent (upstream), affiliate-to-affiliate (cross-stream) and unaffiliated guarantees, however, are subject to attack as a fraudulent transfer since it is questionable how the guarantor receives reasonably equivalent value in exchange for assumption of the guarantee. An intracompany guarantee is a guarantee granted by one member of a company group to another group member (affiliated company).

| Intracompany Guarantees |

Source:

|